how long can you go without paying property taxes in missouri

In accordance with Section 1431212 RSMo for tax years beginning January 1 2007 if a nonresident reported property taxes paid to another state or political subdivision on their federal Schedule A they must report the amount of property taxes paid to a state other than Missouri as an addition modification on Form MO-A unless that state or political subdivision allows a. Under Missouri law when you dont pay your property taxes the county collector is permitted to sell your home at a tax sale to pay the overdue taxes interest and other charges.

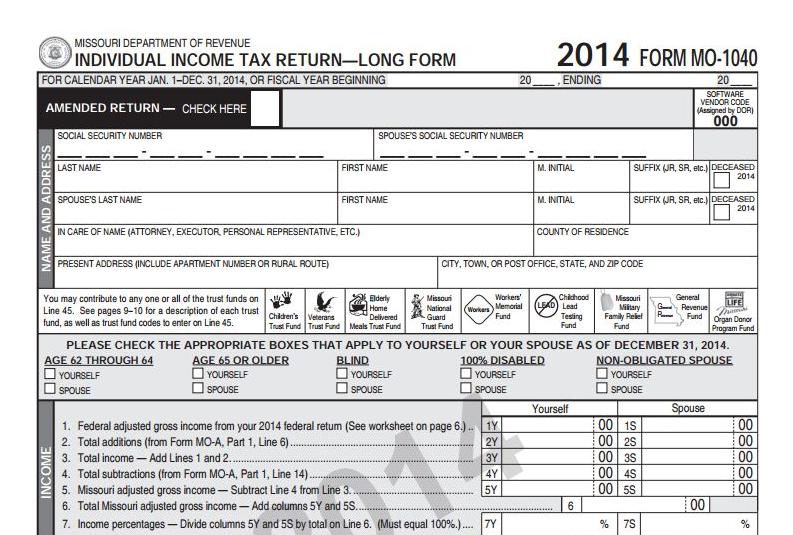

Missouri Income Tax Rate And Brackets H R Block

Can I Pay My Missouri Personal Property Taxes Online.

. At any time on or before the business day immediately before the sale you can pay the taxes and costs due which will stop the sale. This interest typically accrues monthly. If you rent from a facility that does not pay property taxes you are not eligible for a Property Tax Credit.

In Missouri you can ordinarily redeem your home within one year after the tax sale and up until the purchaser gets the deed to your homeif the property sells. ECheck - You will need your routing number and checking or savings account number. If you dont pay your property taxes when theyre due your local taxing authority will start charging interest on your tax account.

The actual credit is based on the amount of real estate taxes or rent paid and total. Do you have to pay personal property tax every year in missouri. Taxes must be paid by that date so on February 1 all unpaid taxes are seen as delinquent.

An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft. Paying property taxes on a monthly or yearly basis is generally considered a good idea. The credit is for a maximum of 750 for renters and 1100 for owners who owned and occupied their home.

The Missouri Department of Revenue accepts online payments including extension and estimated tax payments using a credit card or eCheck. A 2018 claim must be filed by April 18 2022 or a refund will not be issued. In cook county il you can make up to 75000 in home improvements without paying taxes on the increased home value for up to four years.

As for property taxes the homeowner forfeits the property to the agency in the second year of a tax delinquency. If you apply for a vehicle license through the Missouri Department of Revenue license office your online sales tax receipt will be accepted. For most jurisdictions property taxes are due by January 31.

In some cases taxing authorities will honor a January postmark but its best not to take the chance. Interest and Penalties Will Accrue. Some can go as high as 24 depending on where you live.

To pay in person the Missouri Department of Revenue accepts online payments such as extended or estimated taxes using credit cards or E-Checks Electronic Bank Drafts. You may also incur monetary penalties. If you make home improvements check for property tax breaks like these.

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. Another example of when you may want to pay someone elses taxes is if you inherited a property and the property is going through probate which can be a long process in some states. In addition to online receipts at the Missouri Division of Revenue personal property tax receipts can be purchased in person or from the Collectors Office.

In Michigan state law allows any public taxing agency -- state or local -- to claim a lien on property once 35 days have passed after a final bill is sent to the homeowner. Some states allow the property tax authority to foreclose on the home directly if taxes go unpaid. On the first business day of 2021 if you have still not paid everything you owe your property taxes are delinquent.

How Long Can You Go Without Paying Property Taxes In Missouri. This means that the total balance you owe to your local government will begin to steadily increase. To avoid penalties pay your taxes by january 31 2021.

140150 140190. A tax sale must happen within three years though state law permits an earlier sale if the taxes are delinquent. Certain individuals are eligible to claim up to 750 if they pay rent or 1100 if they pay real estate tax on the home they own and occupy.

If the auctioned property is a homestead--meaning it was the primary place of residence for the owner--the owner can buy back his tax deed within two years from the date of. Counties in mississippi collect an average of 052 of a propertys assesed fair market value as property tax per year. How long can you go without paying property taxes in mississippi.

You have until December 31 2020 to pay the second half of your property taxes with all late fees. The original owner of the property can repay the investor for the total amount of money spent at the auction plus 25 percent in penalties and re-acquire legal ownership.

Missouri Sales Tax Guide For Businesses

Find Homes For Sale Market Statistics Foreclosures Property Taxes Real Estate News Agent Reviews Condos Find Homes For Sale Real Estate News Property Tax

Pay Property Taxes Online Jackson County Mo

How To Use The Property Tax Portal Clay County Missouri Tax

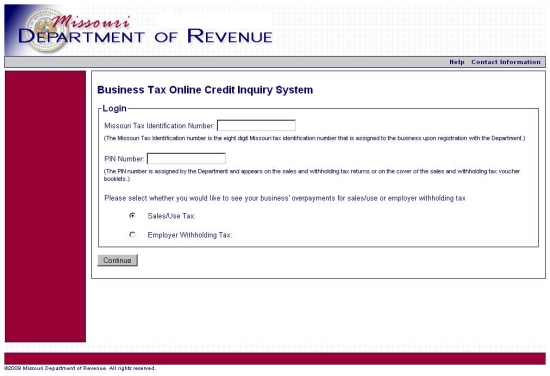

Sales Use Tax Credit Inquiry Instructions

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax States

Missouri Property Tax Calculator Smartasset

Missouri Tax Deadline Still April 15 But Penalties Waived If Paid Within 90 Days Politics Stltoday Com

Missouri Income Tax Calculator Smartasset

Missouri Estate Tax Everything You Need To Know Smartasset

Faq Categories Personal Property Tax Clay County Missouri Tax

Personal Property Tax Jackson County Mo

Missouri Sales Tax Small Business Guide Truic